kansas vehicle sales tax rate

Maximum Local Sales Tax. The sales tax rate on vehicles in Kansas is 73 to 8775or 75 on average.

Sales Tax on Vehicle Sales.

. Maximum Possible Sales Tax. To calculate the sales. Use this publication as a supplement to Kansas Department of Revenues basic.

There are also local taxes up to 1 which will vary depending on region. 635 for vehicle 50k or less. The Kansas Department of Revenue offers this Tax Calculator as a public service to provide payers of Kansas income tax with information to estimate their overall annual Kansas income.

A sales tax receipt is required if you have purchased the vehicle from a Kansas motor vehicle dealer. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Law Enforcement Training Center Surcharge.

Directions for step-by-step driving instructions to Northtowne Lincoln Kansas City or you can always give us a call. Claimants have until April 15 2023 to file an application for this financial assistance. 679 rows 2022 List of Kansas Local Sales Tax Rates.

Department of Revenue guidelines are. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. Kansas State Sales Tax.

Local sales rates and changes. Vehicle Property Tax Estimator. Code or the jurisdiction name then click Lookup Jurisdiction.

The max combined sales tax you can expect to pay in Kansas is 115 but the average total tax rate in Kansas is 8477. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. BACK COVER 3 KANSAS.

775 for vehicle over. Kansas has recent rate changes Thu Jul 01 2021. Destination-based sales tax information.

Sales and Use Tax Document Number. In addition to taxes car. With local taxes the total sales tax rate is between 6500 and 10500.

How to Calculate Kansas Sales Tax on a Car. If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov or. Wed love the opportunity to.

Effective July 1 2002 if the vehicle is purchased in a taxing jurisdiction that has a lower. This publication will address whether sales or compensating use tax is due on a particular vehicle. File withholding and sales tax online.

Kansas has a 65 sales tax and Wyandotte County collects an additional. Kansas offers several electronic file and pay solutions see page 17. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

The state sales tax rate in Kansas is 6500. The total sales tax rate in any given location can be broken down into state county city and special district rates. Withholding Tax returns electronically.

Revised guidelines issued October 1 2009. The minimum combined 2022 sales tax rate for Johnson County Kansas is. The sales tax in Sedgwick County is 75 percent.

County and local taxes can accrue an additional maximum of 4 in sales tax depending on. Lowest sales tax 55 Highest sales. Highway Patrol and Training Surcharge.

In addition the Department has established a dedicated phone line specifically for the COVID-19 Retail. Average Local State Sales Tax.

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Kansas Clarifies Sales Tax Responsibilities For Remote Retailers And Marketplaces

Fuel Taxes In The United States Wikipedia

Kansas Department Of Revenue Reopening

Sales Taxes In The United States Wikipedia

Kansas Sales Tax Calculator And Local Rates 2021 Wise

Kansas Department Of Revenue Home Page

Kansas Vehicle Sales Tax Fees Find The Best Car Price

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

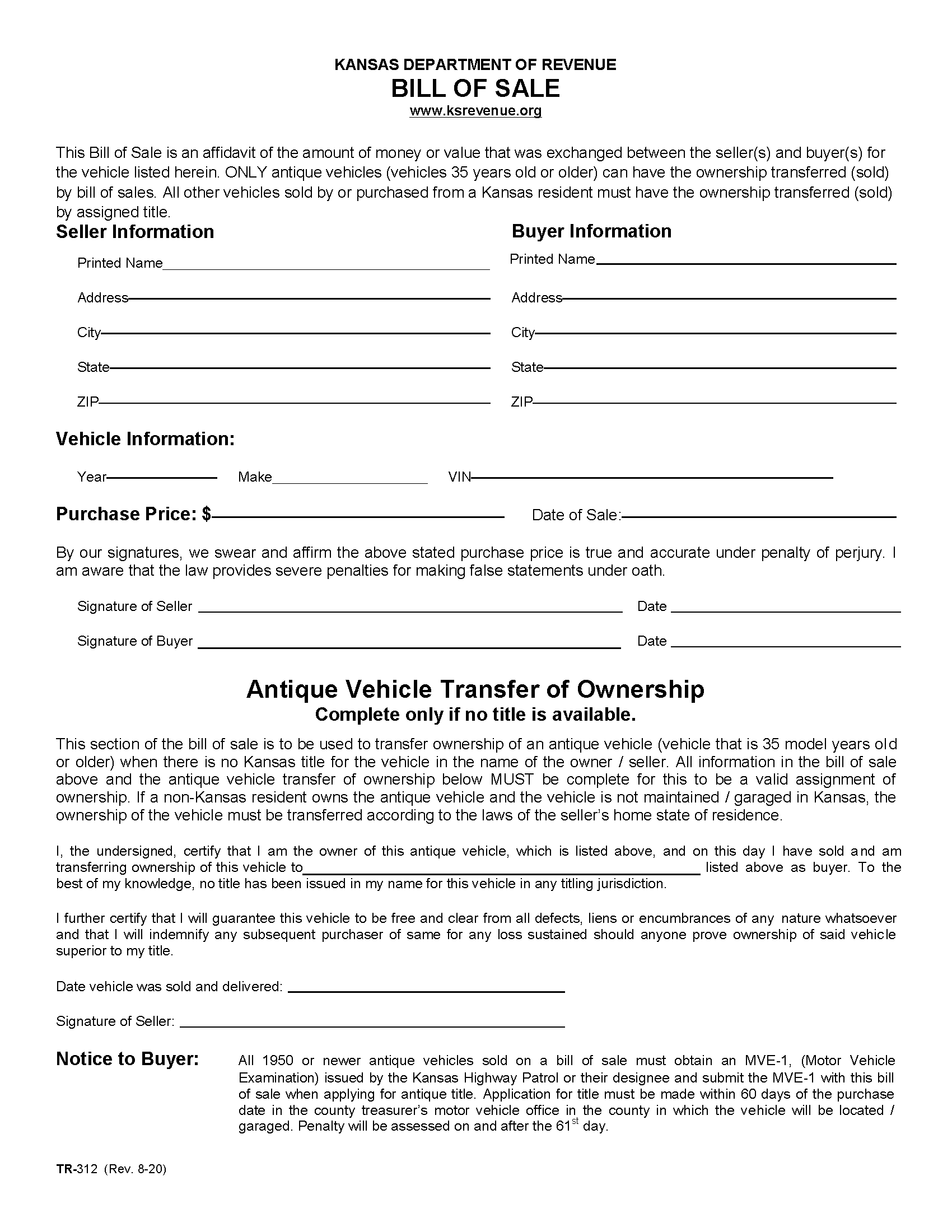

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

County Treasurer Franklin County Ks Official Website

Car Tax By State Usa Manual Car Sales Tax Calculator

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

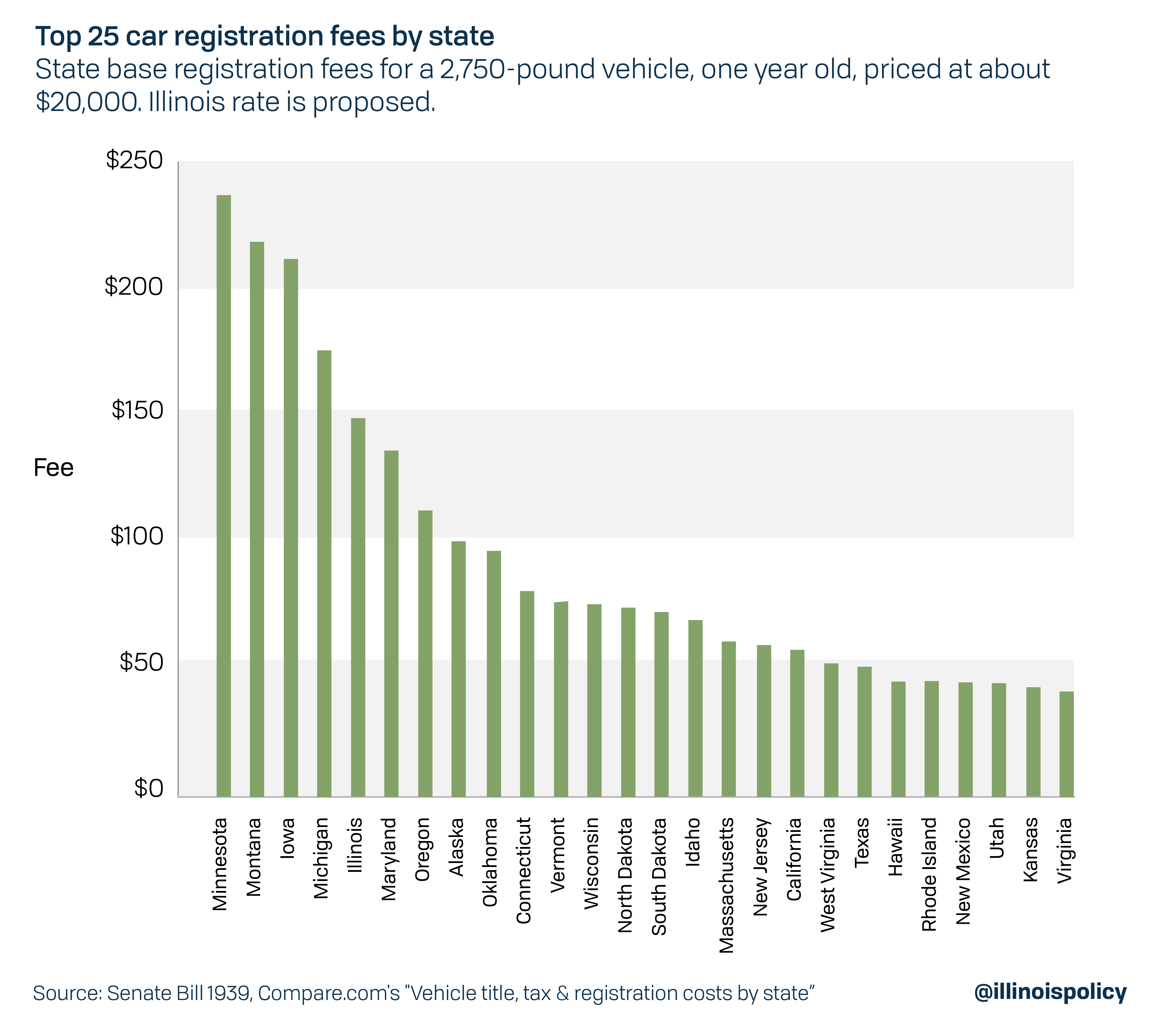

Illinois License Plate Sticker Among Most Expensive In The Nation

Free Kansas Bill Of Sale Forms 4 Pdf Eforms

Nj Car Sales Tax Everything You Need To Know

Free Kansas Motor Vehicle Bill Of Sale Form Pdf Word

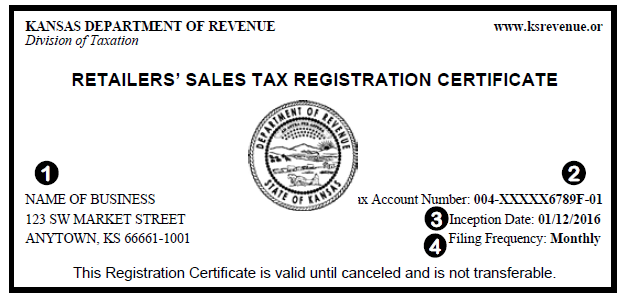

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax